Cfd trading has been gaining traction in the financial world for over a decade now. Though still relatively unknown to a large part of the population, Cfd trading has become a great way to generate profits on the stock market without owning the underlying asset. It allows investors to speculate on the price movement of an underlying asset through contracts drawn up between the trader and the broker. In this blog post, we will dive deeper into Cfd trading, explore its benefits, and discuss how you may add this tool to your investment strategy.

Quickly growing in popularity, cfd trading has become a global trading instrument available on almost all popular trading platforms. One of the biggest advantages of Cfd trading is the leverage effect, offering increased exposure to the financial markets from a given quantity of capital. This allows traders to access a larger market and boost their profits while taking smaller financial positions. By this method, traders can take advantage of high-profit margins, which increase their profit potential. However, while leverage offers benefits, it can also magnify the losses, making it imperative to adopt sound risk management practices.

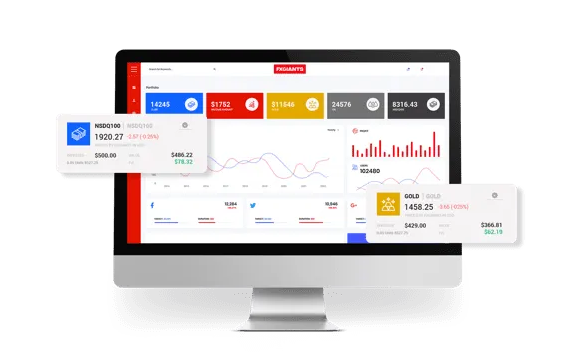

Cfd trading is accessible to traders of all levels of experience, where buyers and sellers come together, waging their own views on an asset’s short-term price movement. Cfd trading ensures that traders benefit equally from rising as well as falling markets. The added benefits of Cfd trading include limited risk, with a tight stop-loss feature, low fees, and ample access to Global markets. Cfd trading empowers traders to take advantage of all market conditions, and a plethora of trading instruments, including forex, commodities, shares, and indices.

Cfd trading has exposed traders to the exciting world of commodities such as gold, silver, copper, and crude oil. Besides offering diversity to your portfolio, commodities serve as a hedge against the economic uncertainty, with their value often inversely correlated to the stock market’s value. The value of commodities is not solely driven by supply and demand, which makes them less predictable, and hence, more lucrative for diversified portfolios. Cfdtrading in commodities is a great option for traders looking for unique investment opportunities.

Cfd trading can be used to hedge an existing position or trade to capitalize on short-term price movements to make profits. Trading CFDs allows you to trade either long or short, offering flexibility for traders to access both long and short positions based on the asset’s prediction. It is an excellent hedging tool that allows traders to mitigate risks and returns, with the minimum investment horizon, and to exercise better portfolio diversification. Cfd trading has now become an integral part of newer investor’s portfolio-building foray, adding leverage and diversity to their trading strategy.

short:

Cfd trading offers a wealth of opportunity to traders looking for better returns on investment. It provides investors the benefit of being on the right side of the market by making informed trades leveraging their market views. It allows investors to capitalize on the changing market trends and profit from short-term price movements. Cfd trading is an essential trading instrument for any level of investor, offering high leverage, diversity, and low fees for an insightful investment journey. Cfd trading empowers traders to trade without being worried about underlying asset ownership while making profits and mitigating risks with ease. A few clicks allow you to access a large market, making it a must-have tool for every investor’s arsenal.